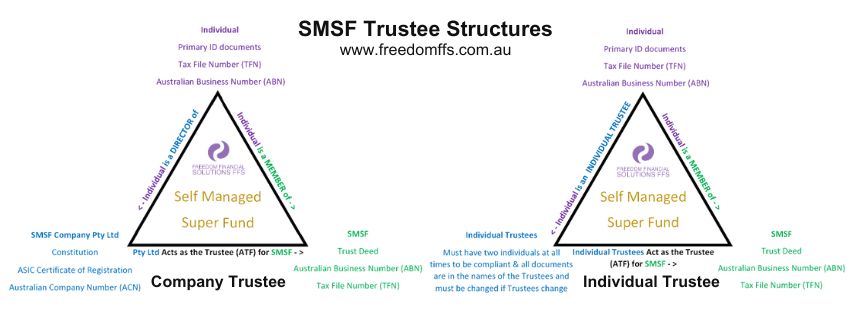

When you set up a self-managed super fund (SMSF) you can choose one of two ‘trustee’ structures: individual or corporate.

Which is ‘better’? That’s up to you. Most of our SMSF clients choose corporate for the following reasons

- single member SMSFs are allowed

- easy to add/remove members as needed (such as with separation or death)

- greater borrowing capacity and/or better interest rates are often offered when borrowing to invest in property

- asset protection (SMSFAdvisor article discusses this in more detail)

- ATO penalties are applied collectively to the one corporate entity, rather than to each individual trustee

- (SMSFAdvisor article discusses this in more detail).

As for personal trustee structure, some clients choose it because

- a Directors Identification Number is not needed

- no annual ASIC renewal or registered agent fees are required

- no annual ASIC paperwork is needed,

However, individual trustees must be aware that

- trustee changes can be costly and time-consuming, and

- in the case of death, a two-member only SMSF will become immediately non-compliant.

For a more detailed comparison of the differences, refer here to the ATO website.