Use it or lose it

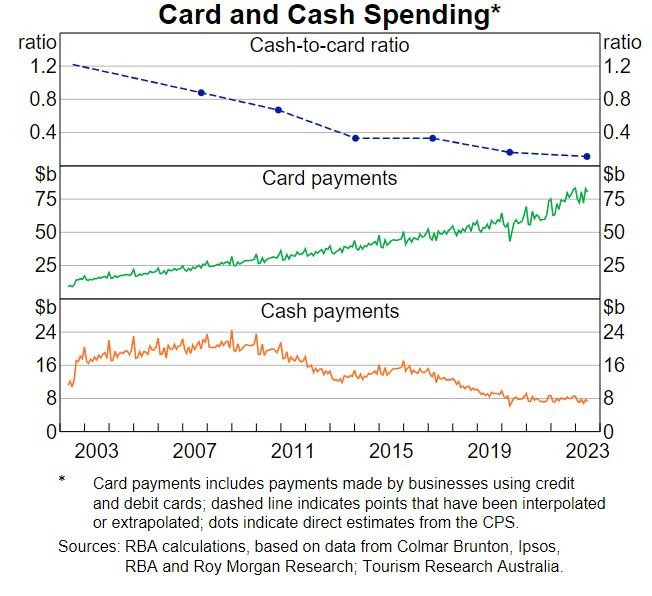

This week we news.com.au reported that “Aussies are being urged to dramatically alter their spending habits as new research indicates physical cash is an endangered species…Back in 2007, about 70 per cent of all transactions were made using cash, but the latest data from the Reserve Bank shows that figure slumped to just 13 per cent in late 2022.’ Read the full article here.

So if you want to stop what some call the ‘privatisation of money,’ go grab some cash and start using it. In good news, The Senior reported there were 30,859,700 ATM cash withdrawals made in Australia during February, up by 166,400 withdrawals from January 2024 (0.5%) and up over 1 million withdrawals compared with February 2023 (3.6%). Read the full article here.

Cashless banks? No impact on SMSFs

This week we delivered a message in person to Macquarie that many of our clients were not happy with the bank’s announcement that they were going cashless, including that some were even looking changing banks as a result.

Senior Macquarie reps took on board our representations that although the bank’s move to cashless technically made no difference to SMSFs – SMSFs must not withdraw physical cash – our clients appeared motivated by the broader principle of choice.

Your choice – things to consider

When this announcement first hit main stream news in September 2023, Cass addressed the issue as follows.

“My position on Macquarie’s announcement is that it makes no difference whatsoever for a SMSF as SMSF’s cannot deal with cash anyway. All SMSF transactions are done through the Macquarie online banking system.

Further, I don’t believe Macquarie’s announcement in anyway paints them as a ‘bad’ bank to deal with. All the major banks will be going this way. In fact, I appreciate Macquarie’s honesty in telling us something they plan to do well in advance in comparison to the other banks who made sudden announcements to be implemented immediately ANZ scraps cash withdrawals in move towards cashless society | 7NEWS and Cash no longer available over the counter at some Commonwealth Bank branches in Sydney, Melbourne and Brisbane | 7NEWS

Macquarie have always been a specialist bank specialising in SMSFs, home loans and business loans. All of which are basically cashless accounts. As a result of the bank’s specialised operations, it has always had very few branches that one could withdraw cash from anyway.

My summary – its business as usual. There is very little point rushing out and changing banks as all banks are headed this way anyway.”

Case study

One of our clients reported their own journey down this path last September when they thought they might make a stand anyway and change banks.

They asked their personal bank about making the change, but ultimately didn’t because

-

- The interest rates were terrible by comparison

-

- It would make the SMSF administration more burdensome for them (ie they would have do to things their SMSF accountant can now do for them)

-

- Doing extra paperwork to set it up was not desirable for them and

-

- The transfer limits for SMSF Macquarie accounts made investing very easy to do.

As we always say, it’s your super, it’s your choice, so it is entirely your choice which bank you choose.

If you do feel strongly about keeping cash as an option for personal (not SMSF) use, then make sure you use it, and let the banks and others know.