Did you know that SMSFs can borrow money to invest in property? They can. We’ll set out the basics of how it works below.

But first, the most important thing to remember in this process is to talk to your accountant and solicitor about what paperwork you need completed BEFORE you make an offer on a property.

All legal paperwork can take time to prepare, so don’t leave it to the last minute. Also, rules vary between States and Territories, which will affect the way your contract is prepared.

The best approach is as soon as you start THINKING about property investment, book in a time with an expert like Jessica to discuss what you need to do.

Bare Trust Basics

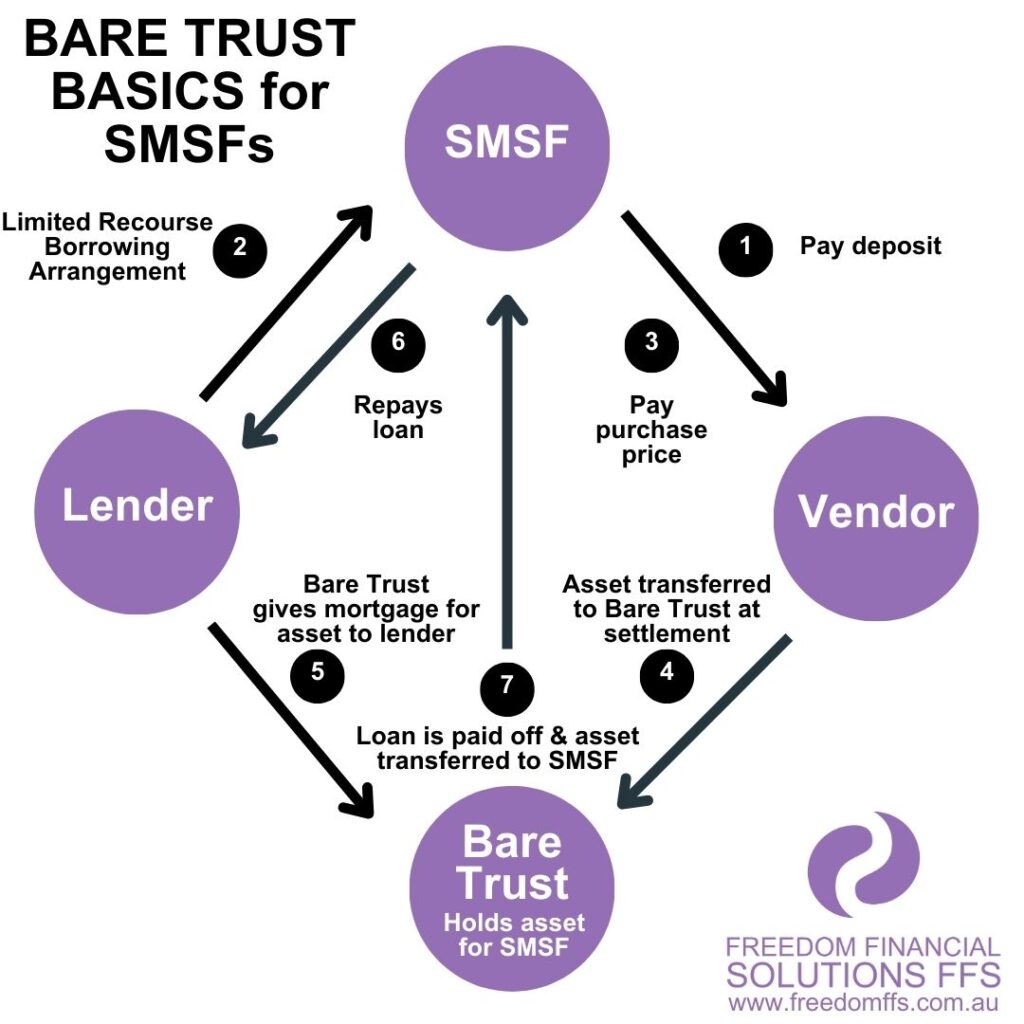

Superannuation legislation does not allow SMSFs to borrow money, except through a Limited Recourse Borrowing Arrangement (LRBA). An LRBA enables an SMSF to borrow money to purchase an asset, most commonly real estate.

There are conditions to this loan arrangement, as follows

- the borrowed money must be used to buy a single asset

- the single asset is held on trust for the SMSF, commonly know as a Bare Trust

- the SMSF owns the asset once the loan is paid in full, and

- if the SMSF defaults on the loan, the lender’s recourse is limited to rights related to that single asset.

So what is a Bare Trust? It is a simple trust structure that hold a particular item of property, such as real estate, on behalf of its beneficiaries.

When your SMSF borrows money to buy an investment property, you need to set up a Bare Trust to hold the property for the SMSF until the purchase price is paid in full.

The Bare Trust holds the title to the asset but does not own the asset.

A Bare Trust is currently $2000+gst, paid from the SMSF, and takes 5 working days to prepare once we have all the required information.

Process of borrowing to buy an SMSF investment property

1. The SMSF pays the deposit to the vendor

2. The SMSF borrows from a lender

3. The SMSF pays balance of the purchase price to the asset vendor (and stamp duty if it is a dutiable asset such as property).

4. The vendor transfers the asset to the Bare Trust which is registered as the legal owner of the title for the asset.

5. The lender will register a mortgage over the asset

6. The SMSF repays the loan in the set period of time

7. Once the loan is paid off, the asset will be transferred to the SMSF and the Bare Trust can be wound up. This is a formal transfer of property requiring the SMSF trustee to be registered as the new owner of the property with the Titles Office. The transfer of the property from the Bare Trust to the SMSF should be exempt from duty, although the specifics of the transfer will vary depending on which State or Territory the property is located in.

Important to know

A Bare Trust can only hold one asset at a time, so you need a new Bare Trust for each property your SMSF borrows to buy.

If the SMSF doesn’t pay off the loan, the lender can only enforce its rights against the asset and cannot touch any other assets held by the SMSF.

More questions? Contact Jessica to find out more.