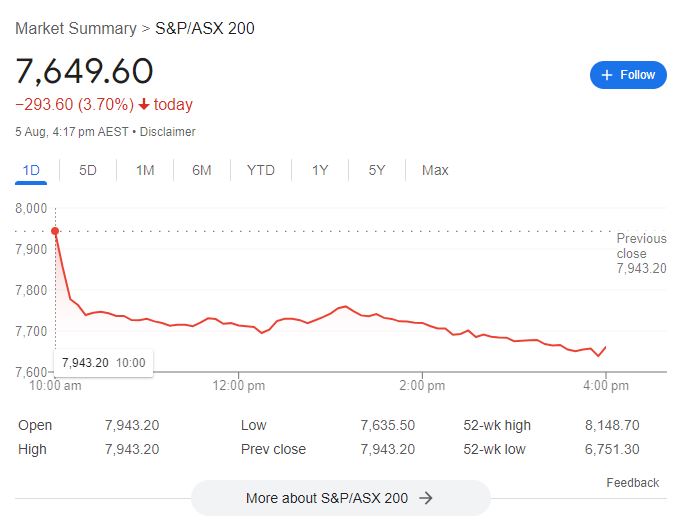

The Australian stock market has plummeted more than 3 per cent to open this week, continuing its Friday fall in what has been the market’s worst two-day performance since 2022. With share markets pushing all-time highs in recent times, is this the beginning of an imminent correction (further downturn)?

The “bloodbath,” which saw $77bn of value wiped from the Australian market followed US employment news showing employers added 35 per cent fewer employees than forecasted as unemployment rose to 4.3 per cent. The US unemployment rate’s jump in July crossed a tripwire that historically has signaled a recession.

On home soil, financial stocks have been hit hard, with Westpac (down 3.76 per cent), ANZ (down 4.04 per cent), NAB (down 4 per cent) and CBA (down 3.88 per cent) all sharply lower.

With echoes of a recession, this begs the question: will gold continue its triumph past all-time highs to finish 2024?

Due to its reputation for being a “safe-haven asset,” gold tends to perform well during a recession. For example, when the stock market collapsed in 2007, investment demand for gold spiked and continued to rise, and gold doubled in value between 2007 and 2011.

SMSFs are able to invest in more than just the stock market, including in assets like gold and property. Perhaps this is the reason more and more Australians are choosing to set up self-managed super funds (SMSFs)? Certainly those who have are sighing with relief this week.

Read more about the recent stock market downturn and gold as a value protecting asset here: