At recent Ainslie Bullion seminars hosted by MyPlace communities across Queensland and during their quarterly online ‘Basics & Banter’, Ainslie experts set out why the official government consumer price inflation (CPI) inflation rate of 3.6% (March 2024) doesn’t feel accurate to most people.

Why? Experts explained that inflation is calculated on a shopping ‘basket of goods and services‘ that people buy, but doesn’t include include assets such as existing housing. The CPI ‘housing’ category only includes rent and the cost of new houses (excluding land), and alternations to existing houses.

What this means is that as assets, such as bullion and existing houses, skyrocket, the wealth of asset owners increases, while the purchasing power of those pegged to the CPI-indexed wage continues downwards.

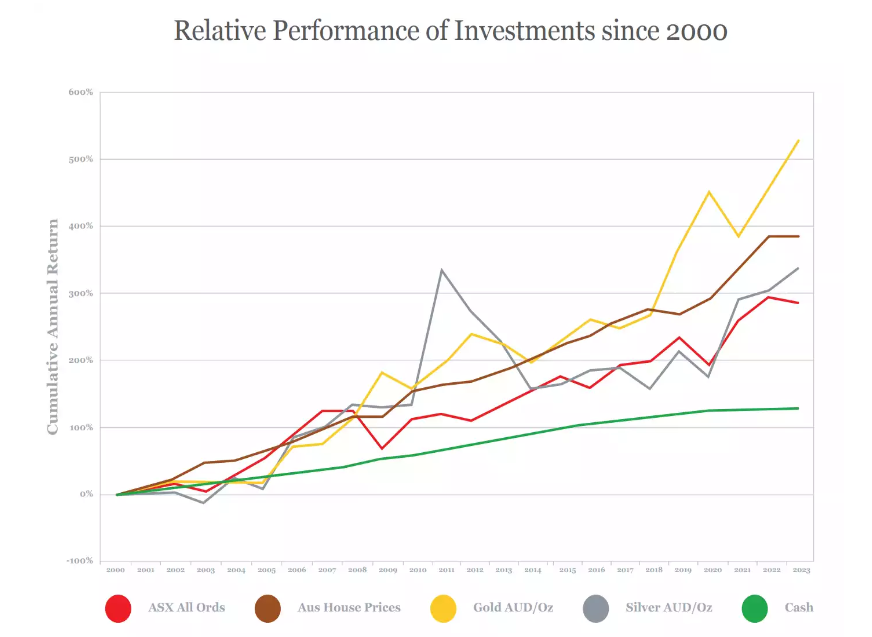

Ainslie’s ‘relative performance of investments since 2000’ chart shows that of all the asset classes, gold has out performed everything, including the ASX All Ords with dividend yield and Australian house prices with rental income. Read the full Gold as a Hedge Against Inflation article here.

Ainslie’s Inflation is Just a Gaslit Number article also covers this in depth highlighting a recent study led by former U.S. Treasury Secretary Larry Summers claiming US inflation is sitting around 18% when adding financing costs including mortgage payments, the phenomenon of ‘shrinkage’ and the ‘McDonald’s index’, and more.

These numbers demonstrate that you can believe what your budget tells you, not what the government , who “has no ability to balance a budget or to understand simple economics, is telling you.”

One solution? Invest in real monetary assets. Commodities including silver, gold and copper are up over 30% in this financial year following real world inflation. And in times of rising inflation and economic turbulence, gold has consistently proven itself as a reliable hedge and a store of value. Its historical performance during periods of inflation, such as the 1970s, the Global Financial Crisis, and the 2020 upheaval, underscores its enduring appeal for investors seeking stability and protection against eroding purchasing power.

As the world grapples with economic uncertainties, gold bullion stands strong as a beacon of financial security.